Case Study "Silicon Valley Bank Collapse"

Silicon Valley Bank (SVB) is a leading bank in the technology industry, providing financial services to startups and venture capitalists. Recently, SVB faced significant financial difficulties, ultimately leading to its collapse. The share price of this bank plummeted nearly 60% in a single day. In this blog post, we will talk about the reasons behind the collapse of SVB but before that let's go through it's history and supremacy.

History

Founded in 1983, Silicon Valley Bank has supported more than 30,000 entrepreneurial companies on the road to success, including some of the best-known companies in the technology industry. Throughout its history, Silicon Valley Bank has vastly expanded its products and services and now targets companies of any stage or size, including those doing business internationally. SVB has business with nearly half of all the US venture-backed startups and 44% of the US venture-backed tech, healthcare firms that went public last year. As of of December 31, SVB had $212 billion in assets. The bank clients includes top companies like Shopify, Pinterest, Paytm, Shaadi.com etc.

Operating Model

The operating model of the Silicon Valley Bank (SVB) revolves around providing financial services to startups and venture capitalists. SVB offers a wide range of banking services, including commercial banking, investment banking, and private banking, as well as other specialised services tailored to the unique needs of the technology industry. One of the primary services that SVB offers to its clients is lending. The bank provides various types of loans, including working capital loans, equipment financing, and lines of credit, to help technology startups finance their growth. SVB also offers venture debt financing, which allows startups to borrow money without diluting their equity.

Why did it collapse ?

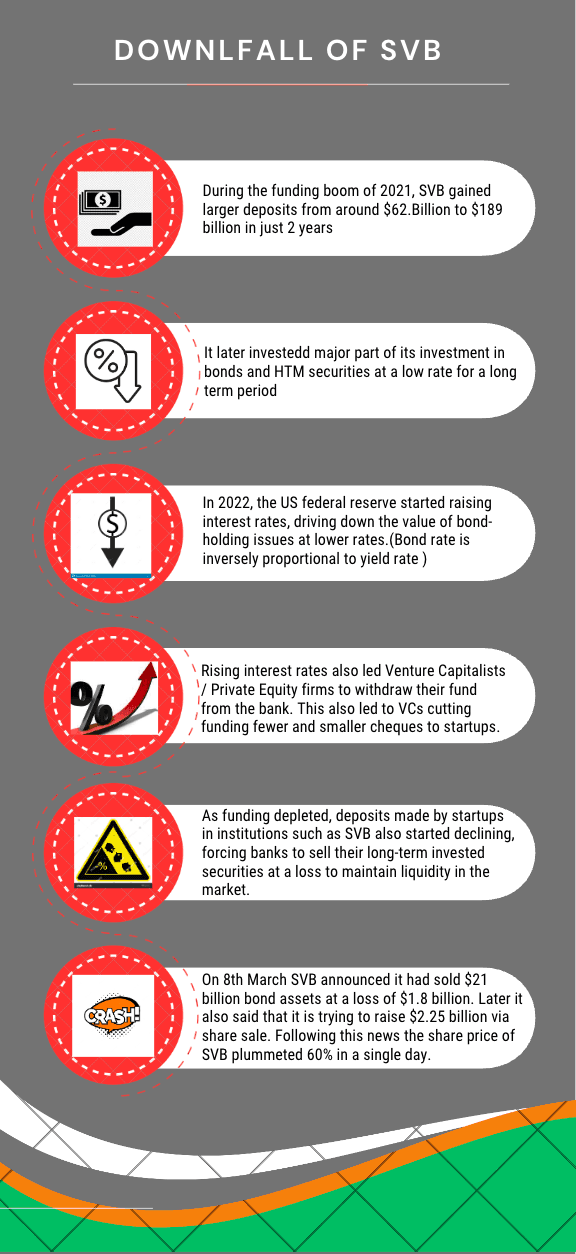

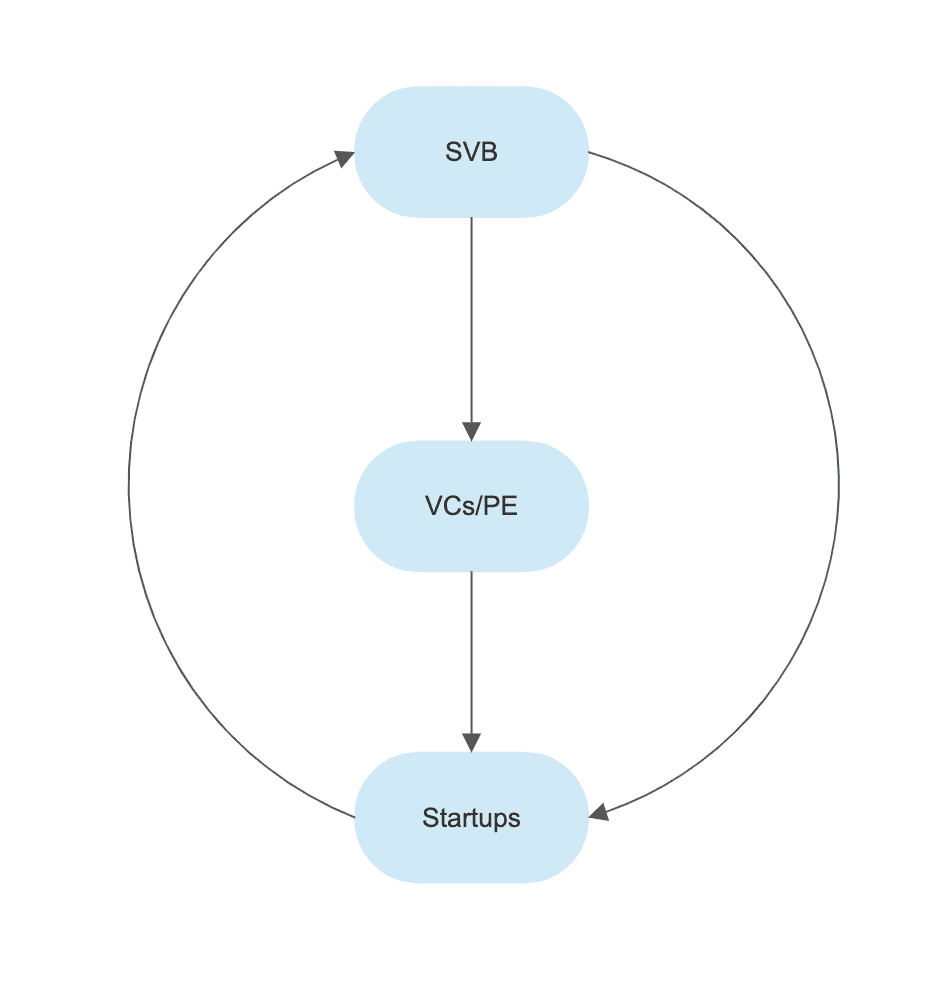

The primary reason for SVB's collapse was the bank's overexposure to the technology industry. SVB had been lending heavily to technology startups worldwide, Private Equity & Venture Capitalists, particularly those in the internet and software industries. These startups were experiencing rapid growth and attracting large amounts of venture capital, which fuelled their expansion. However, this growth was unsustainable, and many of these companies were not profitable. As we know after the Covid-19 there was huge impact on the world's economy and to cope up with it the US Federal Reserve started to increase the interest rates to combat inflation, the value of bonds issued at lower interest rates had decreased, resulting in significant unrealised losses for banks. Furthermore, the rising interest rates contributed to a decline in funding for startups, as venture capitalists became more cautious. Below are the two main reasons for the collapse of the SVB

1. Decrease in new loans being issued and deposit withdrawals

SVB was primarily considered to cater startups, startups on raising a funding round, after bearing their operational expenses, deposit the remaining amount back in the banks for future purposes. Increase in the business loan lending rates due to the economic crisis made the startups hesitant on taking up a new loan for their operational and financial needs, and they realised that withdrawing their own money from the SVB would be a better option that taking up a business loan. This caused the SVB to give out a lot of the money that they had held of various startups even when they did not have enough liquidity to do so.

2. Bad Investment Decisions

SVB had a lot of their money invested in HTM securities (Held to Maturity bonds) as a long term investment and as soon as the startups started to withdraw their money, SVB not having enough liquidity to give out the money, had to sell the HTM securities at a fairly low price in the current market causing a financial collapse.